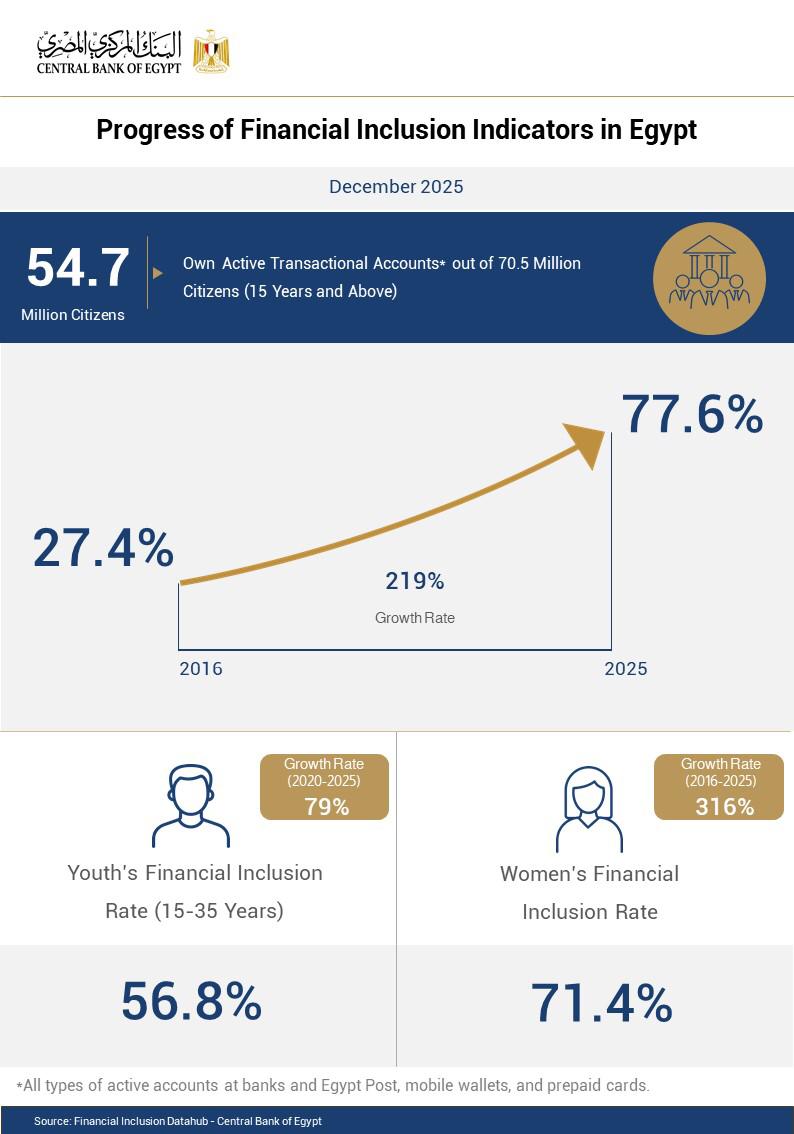

In line with the efforts of the Central Bank of Egypt (CBE) and the financial sector, Egypt’s financial inclusion rate increased to 77.6% by the end of 2025. This translates to 54.7 million citizens owning active accounts that enable them to perform financial transactions, out of a total of 70.5 million citizens (aged 15 years and above), reflecting a growth rate of 219% between 2016 and 2025.

The Central Bank of Egypt

Active accounts encompass bank accounts, Egypt Post accounts, mobile wallets, and prepaid cards. The surge underscores the success of the Financial Inclusion Strategy (2022-2025) in achieving its objectives and fostering sustainable economic growth across all segments of society. The strategy was developed through consultation and coordination with relevant ministries and authorities, drawing on the findings of the financial services demand side surveys for individuals and Micro, Small, and Medium-sized Enterprises (MSMEs), which were conducted in cooperation with the Central Agency for Public Mobilization and Statistics (CAPMAS) in 2020.

The core set of indicators issued by the CBE’s Financial Inclusion Datahub showed a significant expansion in access to financial services, with women’s financial inclusion rate increasing from 19.1% in 2016 to 71.4% by the end of 2025, representing a growth of 316% over the period. Similarly, the financial inclusion rate of youth (aged 15 to 35 years) increased from 36.3% in 2020 to 56.8% in 2025, marking a growth rate of 79%.

The achieved milestones were supported by the tailored programs and initiatives aimed at enhancing the economic empowerment of women and youth, while integrating the underserved segments into the formal financial system.

In alignment with the evidence-based approach adopted by the CBE to achieve its vision and objectives, the Second Financial Inclusion Strategy (2026–2030) is currently under development. This process involves close collaboration with Ministries including Planning and Economic Development, Finance, Communications and Information Technology, Agriculture and Land Reclamation,

Social Solidarity, Justice, Education and Technical Education, Higher Education and Scientific Research, Supply and Internal Trade, Youth and Sports, and Investment and Foreign Trade. In addition to close coordination with the Financial Regulatory Authority, Egypt Post, the National Council for Women, the Micro, Small, and Medium Enterprises Development Agency (MSMEDA), and the Internal Trade Development Authority.

The new strategy builds on the findings of the financial services demand side survey currently carried out in cooperation with CAPMAS, with technical assistance from the World Bank Group and the International Finance Corporation (IFC). The survey aims to identify the financial services’ usage, as well as barriers and gaps to accessing them, providing the foundation for evidence-based financial inclusion policies to stimulate savings, expand financing to support the targeted growth, and strengthen citizens’ resilience against economic challenges.

The strategy priorities include expanding usage of financial services and products through promoting digital solutions and innovation, supporting the transition to a green economy through sustainable financing instruments, in addition to raising financial awareness among citizens through educational and literacy programs. It also aims to strengthen trust in the financial sector by protecting consumer rights, supporting the growth and sustainability of SMEs and entrepreneurs, reinforcing public-private partnerships, and advancing financial and technological infrastructure.

The success of the First Financial Inclusion Strategy (2022-2025) demonstrates Egypt’s commitment to promoting financial inclusion as a cornerstone of economic and social development. This commitment is reflected in the intensified collaboration among various relevant entities to ensure the objectives of the Second Strategy are achieved.