The Financial Action Task Force (FATF) has officially recognized Egypt’s experience

as one of the international best practices in balancing financial inclusion with adherence

to anti-money laundering (AML) and counter-terrorist financing (CFT) standards The recognition

was highlighted in FATF’s updated Guidance on Financial Inclusion and AML/CFT Measures, released

in June 2025 This milestone underscores Egypt’s leadership in financial reform, spearheaded by the

Central Bank of Egypt (CBE) in collaboration with the Egyptian AML/CFT Unit, demonstrating how

regulatory innovation can expand access to finance while preserving financial integrity

Who is FATF and Why This Recognition Matters

Established in 1989 and headquartered in Paris, the FATF is a 40-member intergovernmental

body that sets international standards to combat money laundering, terrorist financing, and the

financing of proliferation of weapons Its guidelines influence national regulations and global

compliance practices across all financial systems By featuring Egypt’s approach as a model for

other countries, the FATF affirms that inclusive financial systems can and must coexist with

robust financial crime controls

CBE’s Balanced Approach: Inclusion with Integrity

According to the FATF Guidance, the CBE has played a pivotal role in designing

and implementing comprehensive regulatory frameworks that support equitable access

to financial services, while maintaining strict AML/CFT compliance. These efforts have

helped economically empower underserved populations without compromising the safety

and transparency of Egypt’s financial system

Among the most impactful CBE initiatives

Simplified customer due diligence (CDD) for individuals and micro-enterprises

Opening bank accounts for youth (ages 15+), craftsmen, and freelancers using national ID only

Allowing banking agents to verify customer identity, expanding financial outreach

Development of tailored financial products for women, youth, and people with disabilities

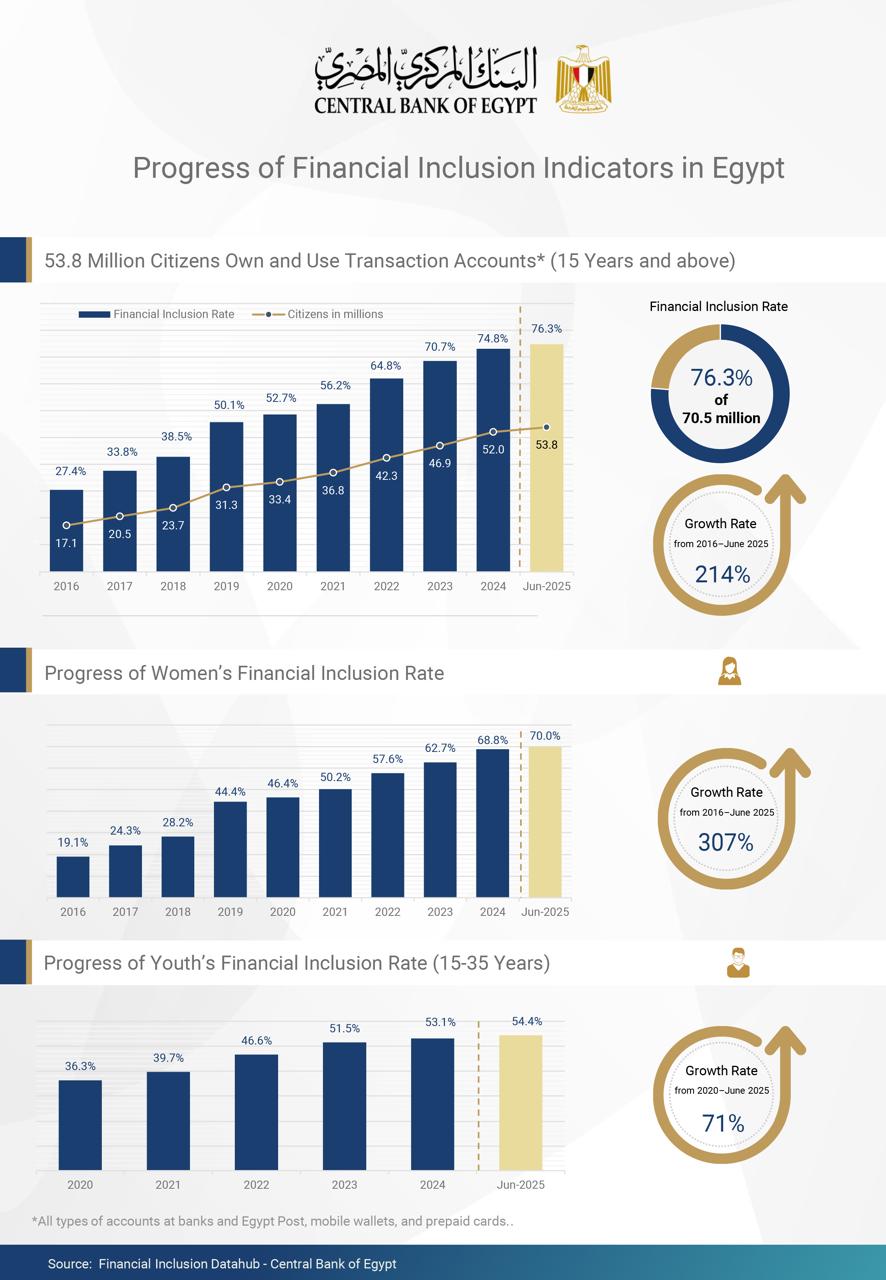

Advancing Digital Financial Inclusion in Egypt

In line with Egypt’s national digital transformation strategy, the CBE has advanced

digital financial inclusion by

Promoting the adoption of e-wallets and prepaid cards

Issuing licensing and regulatory frameworks for digital banks

Supporting remote access to financial services, especially in underserved areas

These digital policies are designed to bridge the financial access gap, especially in rural

regions, while ensuring all digital channels meet security and compliance standards

Strengthening Egypt’s Financial Infrastructure

The CBE’s vision also includes strengthening key financial institutions

Enhancing the role of I-Score (the Egyptian Credit Bureau) in assessing creditworthiness

Expanding the function of the Credit Risk Guarantee Company to support financing for SMEs

a vital driver of Egypt’s economy

These measures reflect Egypt’s commitment to building a resilient financial system that

supports innovation, financial access, and economic growth

A Strategic Milestone: Remarks by CBE Governor Hassan Abdalla

Commenting on the FATF recognition, CBE Governor H.E. Mr. Hassan Abdalla stated

This global recognition reinforces our strategic commitment to building an inclusive financial

system that protects national financial stability while empowering citizens through access to

formal financial services He added that the recognition reflects the fruitful cooperation between

the CBE, the AML/CFT unit, and other national stakeholders, and serves as validation of Egypt’s

leadership in the financial regulatory landscape

Egypt’s Role in Shaping Global AML/CFT and Inclusion Standards

The updated FATF guidance was developed in collaboration with key international stakeholders

including the Central Bank of Egypt and the Egyptian AML/CFT Unit. This participation reflects

Egypt’s thought leadership and influence in shaping global financial inclusion and compliance strategies

The document encourages countries worldwide to adopt risk-based, proportionate approaches to AML/CFT

compliance that do not hinder financial inclusion goals — a balance Egypt has demonstrably achieved

Egypt’s inclusion in the FATF’s list of global best practices reaffirms its position as a regional and international

leader in financial inclusion, AML/CFT regulation, and digital transformation. With the continued efforts

of the Central Bank of Egypt, Egypt is well-positioned to remain a benchmark for how developing

economies can achieve inclusive, safe, and compliant financial systems