In a strategic move to enhance the resilience and global competitiveness of the Egyptian

banking sector, the Central Bank of Egypt (CBE) has officially launched the Banking Reform

and Development Fund, a pivotal initiative aimed at accelerating banking modernization and

supporting digital transformation in line with international best practices

The Fund’s Board of Directors (BoD) has been appointed for a four-year term and is chaired

by H E Mr Hassan Abdalla, Governor of the CBE The Board brings together prominent leaders

from the banking, finance, and information technology sectors, ensuring a broad and innovative

approach to sector development

Central Bank:Board Composition Reflects Cross-Sector Expertise

Central Bank The Fund’s governance structure is designed to provide strategic oversight with

a well-rounded mix of expertise It includes

Mr. Rami Aboulnaga, Deputy Governor for Monetary Policy

Mr Tarek ElKholy, Deputy Governor for Banking Stability

Five bank leaders elected by the Federation of Egyptian Banks (FEB)

Mr Mohamed El-Etreby, CEO, National Bank of Egypt

Mr Mohamed Abbas Fayed, CEO, First Abu Dhabi Bank – Egypt (FABMISR)

Mr Akef El Maghraby, CEO and Managing Director, Suez Canal Bank

Mr Tamer Waheed, Vice Chairman and Managing Director, AAIB

Mr Mohamed Abdelkader, Managing Director, Citibank Egypt

Three independent members from outside the banking sector

Mr Mohamed Abdallah, CEO, Vodafone Egypt & Regional Head at Vodacom

Eng Hoda Mansour, Vice Chair and MD at Sukari Gold Mines

Mr Tarek Abdel-Rahman, CEO, Bonyan for Development and Partner at Compass Capital

Strategic Priorities: Innovation, Cybersecurity, and Talent Development

Chaired by the Governor, the Fund’s inaugural meeting focused on laying out a strategic roadmap

defining priorities, and setting a robust governance framework The Fund will act as a catalyst for

change, supporting projects that aim to upgrade the banking sector’s technological infrastructure

enhance cybersecurity resilience, and build human capital capacity

Governor Hassan Abdalla emphasized that this Fund is a cornerstone in Egypt’s comprehensive

financial reform agenda, with a clear mandate to increase the sector’s efficiency, technological

adaptability, and global competitiveness He also highlighted the importance of drawing on diverse

sectoral expertise to guide strategic planning and execution

Fund’s Objectives: Digital Transformation, Financial Inclusion, and Resilience

Established under Law No. 194 of 2020 (Central Bank and Banking Sector Law), the Fund

operates as an independent legal entity affiliated with the CBE It includes all banks as

members and maintains independent financial statements

Its core objectives include

Enhancing national payment infrastructure

Promoting digital banking and FinTech innovation in Egypt

Addressing IT incidents and cyber threats effectively

Supporting business continuity and recovery plans

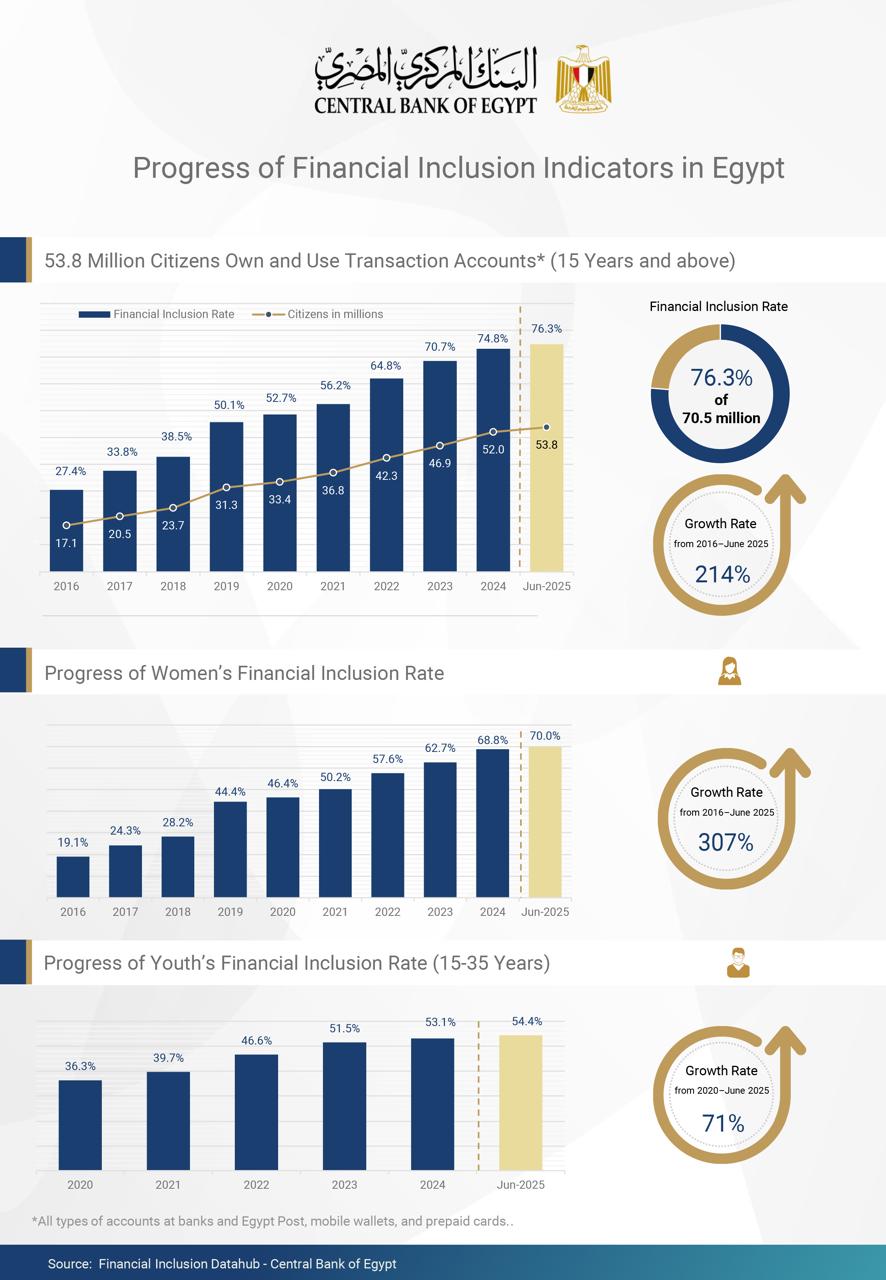

Strengthening financial literacy and expanding financial inclusion

Encouraging banking product and service innovation

Improving operational efficiency across institutions

Flexibility to Invest and Collaborate at National and Global Levels

Central Bank To achieve its mission, the Fund is authorized to

Establish or invest in joint-stock companies

Enter into partnerships, MoUs, and cooperation agreements with relevant local and international stakeholders

Promote knowledge exchange and drive cross-border collaboration for sustained banking sector growth

Central Bank: A New Chapter for Egypt’s Banking Sector

The launch of the Banking Reform and Development Fund marks a significant milestone

in Egypt’s journey toward a modern, inclusive, and resilient financial system Backed by

a strong governance structure and strategic vision, the Fund is set to play a transformative

role in supporting innovation, protecting digital infrastructure, and building a future-ready banking ecosystem