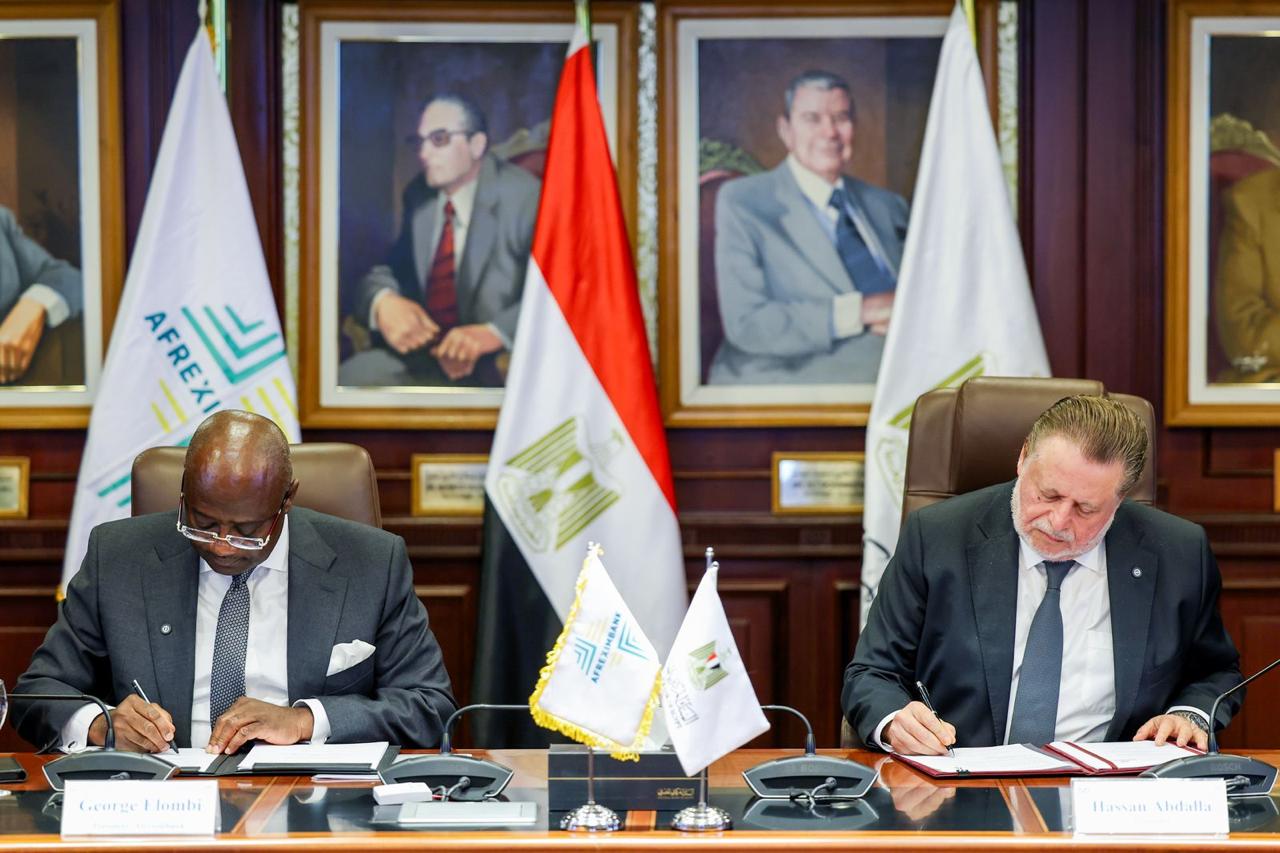

H.E. Mr. Hassan Abdalla, Governor of the Central Bank of Egypt (CBE), and H.E. Mr. Alaa Farouk

Minister of Agriculture and Land Reclamation, conducted a field visit today in several villages in Aswan

Governorate to review the “Transforming the Livelihoods of Smallholder Farmers project This project

is a collaboration between the CBE, the banking sector, the Ministry of Agriculture, and the UN’s World

Food Programme (WFP) The visit was accompanied by Major General Dr. Ismail Kamal, Governor of Aswan

and Ms Rawad Halabi, WFP’s Country Director and Egypt Representative, along with senior officials from the

CBE, the banking sector, and the Ministry of Agriculture

Empowering Smallholder Farmers through Financial Inclusion and Sustainable Practices

Central Bank The project’s objective is to integrate smallholder farmers into the formal financial system

and provide tailored financial products and services This aims to improve the farmers’ economic

and social livelihoods by optimizing the use of natural resources, including land and water It also

focuses on women’s economic empowerment and the enhancement of financial literacy within

rural communities

Key Highlights of the Visit: Solar Irrigation and Agricultural Innovation

During the visit, Mr. Abdalla and Mr. Farouk visited a solar-powered irrigation station in Armana

village and observed a model for cultivating sugarcane seedlings using solar-powered drip irrigation

systems in Eniba village They engaged with project beneficiaries, toured agricultural fields, and

inspected productive enterprises The delegation also reviewed on-the-ground activities, including

technical support and training for farmers, the provision of agricultural inputs, and the promotion

of sustainable farming practices that are increasing production and boosting the incomes of rural households

Promoting Financial Inclusion in Aswan’s Villages

Mr. Abdalla and Mr Farouk reviewed the CBE’s efforts in promoting financial inclusion

in Aswan’s villages They also participated in training sessions for women focusing on

upcycling palm waste into handicrafts and agri-processing techniques such as producing

energy balls and dates. The visit concluded with a tour of an exhibition featuring local women’s

products, which were praised for their quality and craftsmanship

Strong Partnership for Sustainable Agricultural Development

In his remarks, Mr. Hassan Abdalla, Governor of the CBE, expressed his satisfaction with the

warm hospitality in Aswan and praised the success of the “Transforming the Livelihoods of

Smallholder Farmers” project He highlighted the tangible impact the project has had on

improving living standards and economic empowerment in rural Egypt He emphasized the

importance of state institutions, the banking sector, and international partners working together

for sustainable development in Upper Egypt He further noted that the project aligns with the

government’s strategy to support smallholder farmers, integrate them into the formal financial

system, and promote financial inclusion This helps improve citizens’ livelihoods and optimizes

the use of natural resources, especially in the Upper Egypt governorates and other underprivileged

areas Additionally, Mr Abdalla highlighted the CBE’s focus on empowering women and developing

rural communities that are better equipped to confront economic and environmental challenges

Ministry of Agriculture’s Role in Supporting Smallholder Farmers

Mr Alaa Farouk, Minister of Agriculture and Land Reclamation, emphasized that smallholder

farmers are the backbone of Egypt’s food security and the agricultural sector’s future He

stressed the importance of providing these farmers with the necessary support and noted the

success of the partnership between the CBE, the Ministry of Agriculture, and the WFP

Mr Farouk outlined the Ministry’s role in providing technical support, modern agricultural advisory services

and access to improved seeds and agricultural mechanization He also emphasized that the Ministry’s Executive

Agency for Comprehensive Development Projects (EACDP) would ensure that the support reaches the eligible

farmers This includes accurately identifying smallholder farmers, supervising project implementation, and

optimizing resource usage to enhance project success

Achievements of the Project’s First Phase

The first phase of the project, which ran from January 2021 to June 2022, benefited

approximately 85,000 smallholder farmers Key outcomes included the consolidation and

development of 8,500 feddans of agricultural land, the introduction of modern irrigation

systems, and the installation of solar panels These initiatives led to a 34% increase in crop

production and a 35% increase in revenues for farmers In addition, the project reduced operational

costs by 37.5%, supported the capacity-building of 50 social and civil organizations, and trained 2,250

individuals, with 31% of participants being women The first phase also offered financial literacy training

to 34,000 beneficiaries, including 47% women, and funded 15,000 women in establishing livestock projects

, which resulted in an income increase of up to 55%

Expanding the Project’s Impact in the Second Phase

Central Bank The second phase of the project began in January 2025 and will extend through December

2026, with total funding of EGP 120 million The new phase targets 11 additional villages and will

continue the cultivation of strategic crops, including sugarcane, along with export-oriented

cash crops such as cantaloupe By 2025, the initiative is expected to support 23,500 beneficiaries

develop and integrate 400 feddans of agricultural land, and install 21 solar-powered stations with

a combined capacity of nearly 1,000 kilowatts