The Central Bank of Egypt (CBE) and the African Export–Import Bank (Afreximbank) have

signed a Memorandum of Understanding (MoU) to establish a pan-African Gold Bank programme

in Egypt, marking a major milestone in Africa’s efforts to strengthen gold value chains and retain

mineral wealth within the continent The strategic initiative aims to formalise gold production and

trading, strengthen central bank gold reserves, and reduce Africa’s dependence on foreign refining

and trading hubs, while supporting sustainable economic development across African economies

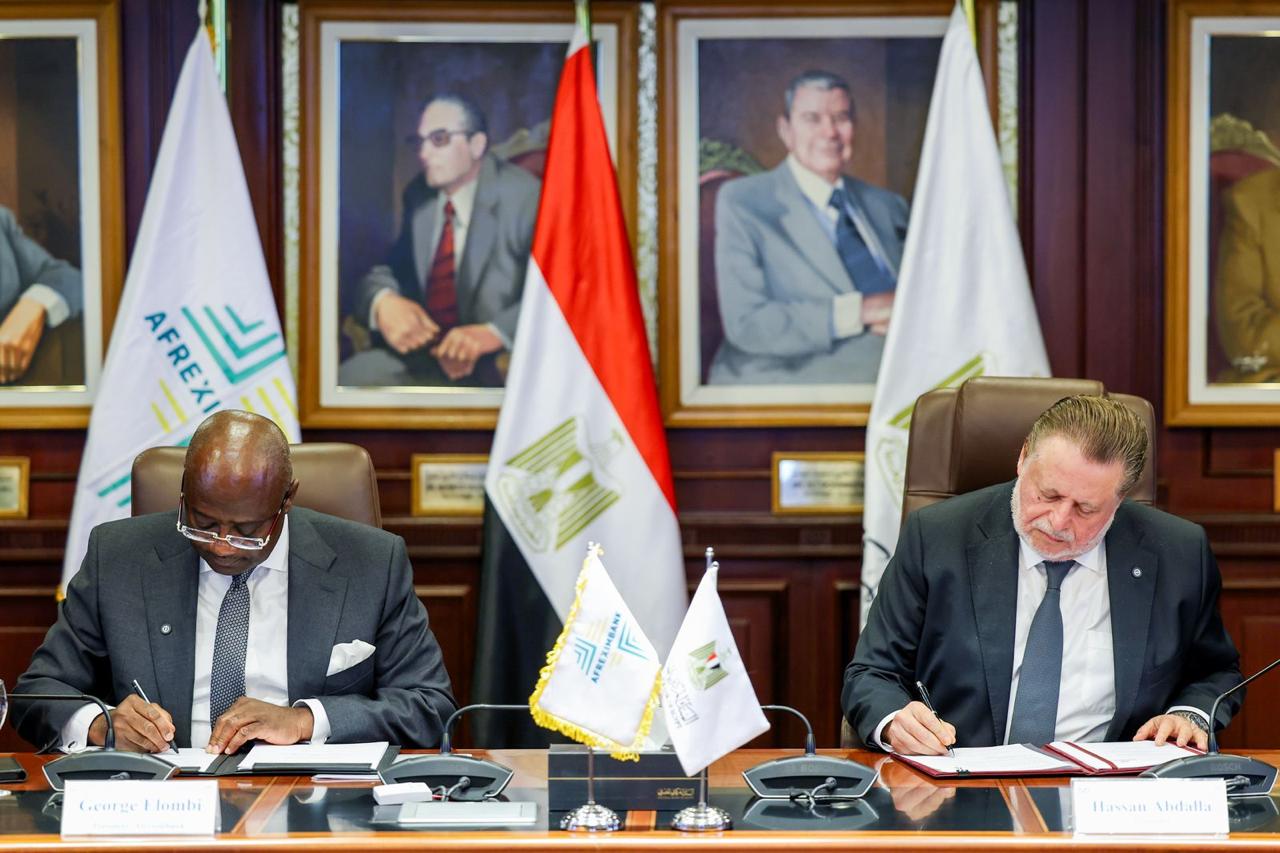

High-Level Signing Ceremony in Cairo

The MoU was signed at the headquarters of the Central Bank of Egypt in Cairo by H E Mr Hassan

Abdalla, Governor of the Central Bank of Egypt, and Dr George Elombi, President and Chairman of

the Board of Directors of Afreximbank, during an official signing ceremony attended by senior

representatives from both institutions

Aligning with Egypt’s Vision and Afreximbank’s Strategic Priorities

The establishment of the Gold Bank programme aligns with Egypt’s national vision to expand

strategic partnerships and deepen cooperation with African countries across key economic sectors

It also supports Afreximbank’s mandate to promote value addition, strategic mineral processing

and industrial development across Africa The partnership reflects a shared commitment to domestic

manufacturing, sustainable development, and regional financial and trade integration, contributing to

the creation of a resilient and advanced African economic ecosystem

Integrated Gold Bank Ecosystem in a Free Zone in Egypt

Under the terms of the MoU, the Central Bank of Egypt and Afreximbank will jointly

commission a comprehensive feasibility study to assess the technical, commercial, and

regulatory requirements for establishing an integrated Gold Bank ecosystem in a designated

free zone in Egypt, with the participation of African countries

The proposed ecosystem includes

An internationally accredited gold refinery

Secure gold vaulting and storage facilities

Specialised financial services linked to gold

Advanced gold trading and market infrastructure

Pan-African Scope and Institutional Collaboration

The initiative is designed to expand across the African continent by engaging governments

central banks, mining companies, and industry stakeholders This approach aims to harmonise

best practices, strengthen institutional collaboration, and facilitate sustainable gold trade and

related financial services within Africa

CBE Governor: Egypt Positioned as a Regional Gold Hub

Commenting on the agreement, Mr Hassan Abdalla, Governor of the Central Bank of Egypt

stated that the initiative represents a foundation for a broader pan-African framework involving

governments, central banks, and market participants He emphasized Egypt’s commitment to driving

African economic integration, noting that Egypt’s selection as a potential hub—subject to feasibility

outcomes and regulatory approvals—reflects strong confidence in the country’s ability to host major

continental projects. With its strategic location linking Africa, the Middle East, and Europe, Egypt is well

positioned to become a regional hub for gold trade and financial innovation

Afreximbank: Africa’s Gold Must Benefit Africans

Speaking at the signing ceremony, Dr George Elombi reaffirmed the joint commitment

of both institutions to align resources and efforts to promote financial stability and sustainable

economic prosperity across Africa He noted that while the MoU may appear simple, its economic

implications are profound The initiative establishes an African Gold Bank that will transform how

Africa extracts, refines, manages, values, stores, and trades gold, with the primary objective of

retaining value within the continent By building strategic gold reserves—similar to practices

adopted by major global economies—the initiative is expected to enhance Africa’s economic

resilience, reduce exposure to external shocks, support currency stability and convertibility

and create long-term wealth across African nations

Strong Institutional Ties Between Egypt and Afreximbank

The Central Bank of Egypt and Afreximbank share a long-standing and strong partnership

Egypt is Afreximbank’s largest shareholder and hosts the Bank’s headquarters in Cairo, further

reinforcing Egypt’s role as a leading financial and economic hub for Africa